LONDON — European stocks moved tentatively higher Friday as traders continue to monitor the escalating conflict in the Middle East and look ahead to the latest U.S. jobs report.

The pan-European Stoxx 600 was up 0.13% by 12:17 p.m. London time, with most sectors and major bourses trading in the green.

Oil and gas stocks added 1.2%, continuing their rally on supply constraint concerns after U.S. President Joe Biden suggested Israel could target Iran’s oil industry. On the other end, health care stocks fell 0.65%.

Automaker shares climbed 1.4%, led by gains for Volvo and Volkswagen, after the European Union on Friday voted to adopt definitive tariffs on China-made battery electric vehicles (BEVs). It comes despite opposition to the measures from many European carmakers, who fear retaliatory tariffs from one of their biggest markets.

Elsewhere, Shares of Danish shipping giant Moller-Maersk fell more than 8% before paring losses slightly after U.S. dockworkers and the United States Maritime Alliance agreed on Thursday to a tentative deal on wages, bringing to a close their three-day strike and easing pressures on the sector.

A prolonged strike would have provided a boost for European shippers to take a larger share of global supply chain demands. Maersk was last seen down 5.6%, while Germany’s Hapag Lloyd lost 12.7% and Switzerland’s Kuehne+Nagel was 1.6% lower.

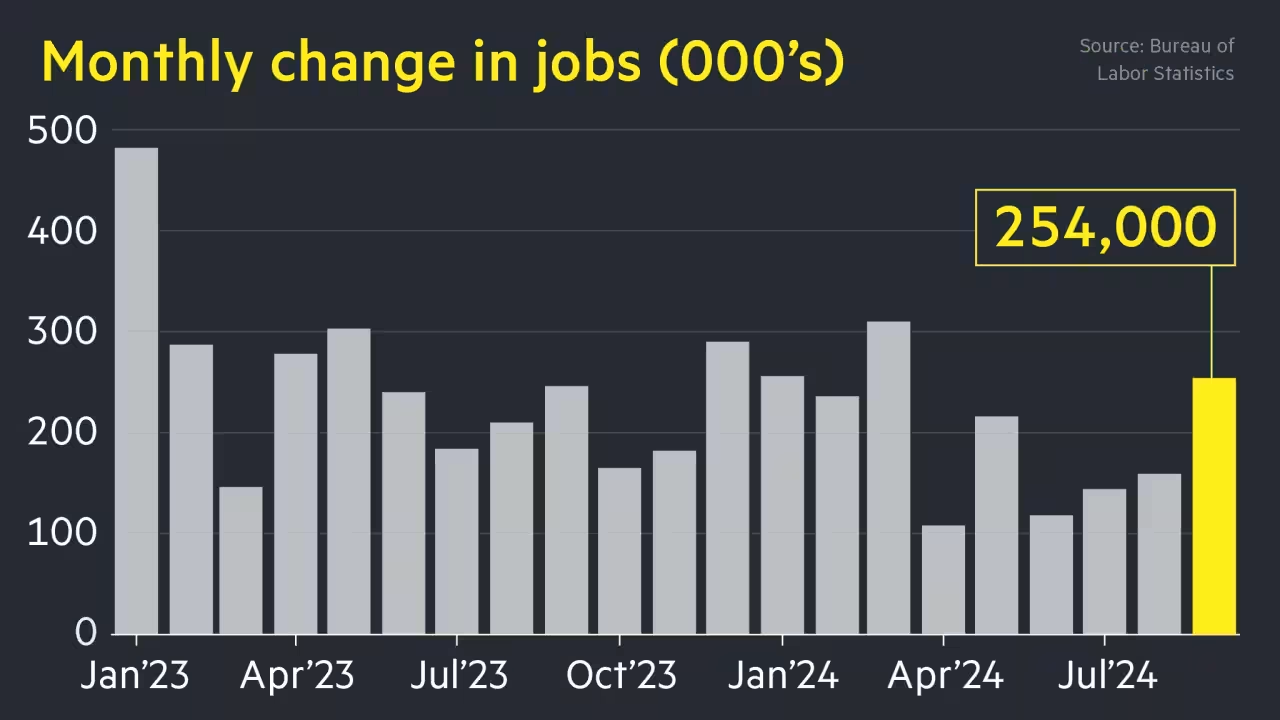

Investors are looking ahead Friday to the September’s payrolls report, with U.S. futures little changed overnight.

Asia-Pacific markets traded mixed on Friday following losses Thursday on Wall Street, with concerns over Middle East tensions keeping investors on edge.

Hong Kong’s Hang Seng index extended its rally, however, on China’s stimulus program, with markets on the mainland still closed for the Golden Week holiday.

Back in Europe, earnings come Friday from U.K. pub chain J D Wetherspoon, while France releases its industrial production data and the U.K. prints construction data.