Gold prices held steady on Thursday as safe-haven demand from escalating tensions in the Middle East offset pressure from a stronger dollar after investors toned down expectations of another big interest-rate cut from the U.S. Federal Reserve.

Spot gold was flat at $2,657.89 per ounce after hitting a record high of $2,685.42 last week.

U.S. gold futures settled 0.4% higher at $2,679.2.

“There’s sort of been a counter balance between factors in terms of geopolitical tensions versus shifts in monetary policy expectations and the resulting rise in the dollar,” said Peter A. Grant, vice president and senior metals strategist, Zaner Metals.

Israel’s military urged residents of over 20 southern Lebanese towns to evacuate immediately amid an ongoing incursion following its worst losses in a year of fighting Hezbollah.

As tensions escalated in the Middle East, the market sort of backed away from expectations of another jumbo rate cut in November, Grant said.

Bullion is considered a safe investment during times of political and financial uncertainty due to its ability to store value, and thrives in a low-rate environment.

The U.S. central bank’s fight to return inflation to its 2% target may take longer than expected, limiting how far interest rates can be cut, Richmond Fed President Thomas Barkin said.

Traders watered down their bets for a 50-basis-point rate cut in November to 33% from 49% last week.

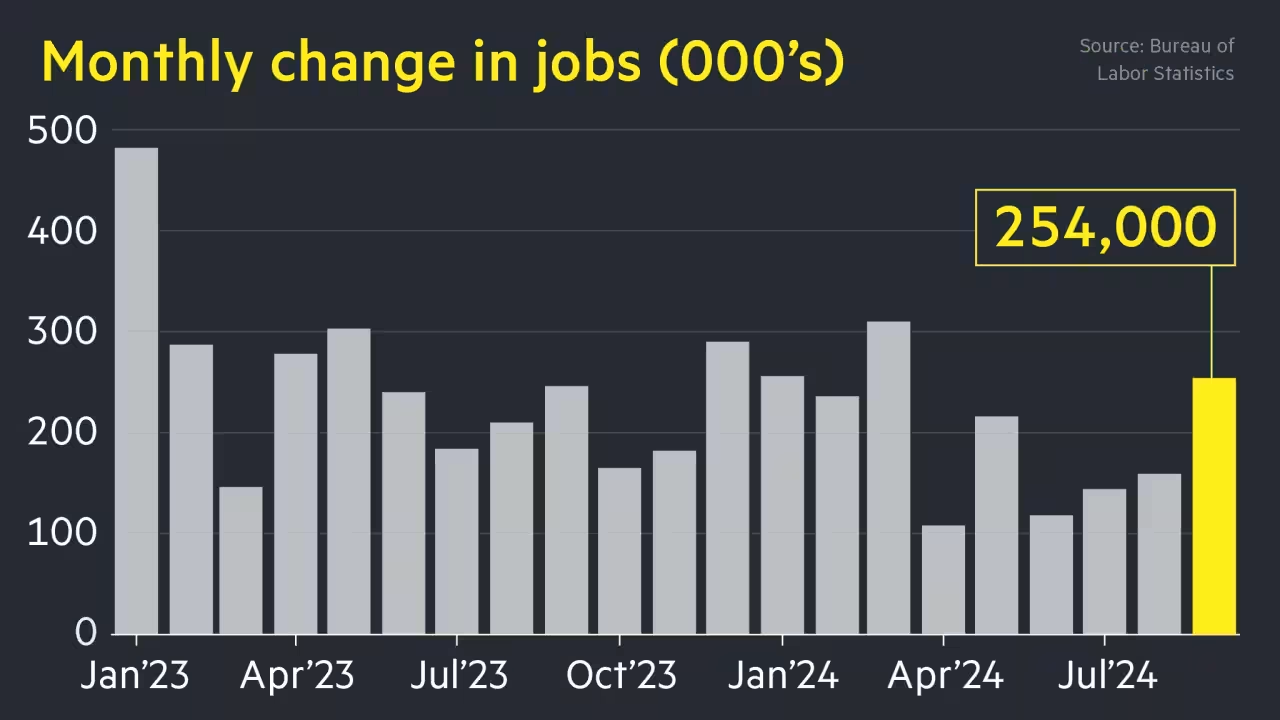

The market focus is now on Friday’s non-farm payrolls report.

“If there is some sense that the Fed has a higher probability of going 50 bps, that would likely be positive for gold and we could see a little further pull back if the alternate occurs,” said David Meger, director of metals trading at High Ridge Futures.

Spot silver rose 0.8% to $32.10, platinum dropped 0.9% to $993.14 and palladium slipped 1.8% to $997.29.